The Private Debt Collection Program

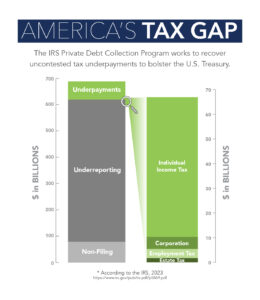

While most taxpayers file and pay their taxes on time, some still have outstanding balances owed to the Treasury of the United States. The IRS estimates that the difference between the total amount of taxes owed and taxes paid – known as the tax gap – currently exceeds $688 billion.

Within the tax gap, active tax underpayment accounts total more than $68 billion in lost federal revenue each year. This is especially concerning with the Nation’s deficit on the rise.

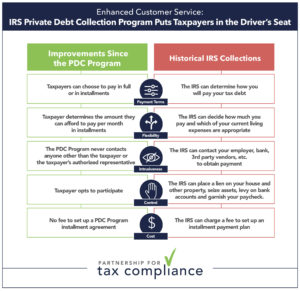

In December 2015, Congress created the Internal Revenue Service (IRS) Private Debt Collection (PDC) Program through the Fixing America’s Surface Transportation Act. The PDC Program provides solutions to help taxpayers voluntarily settle their outstanding tax underpayment debt – where a tax return was filed but taxes are overdue – and provides additional expertise, manpower and resources to help the IRS expand customer service to support taxpayers.

The following companies were selected to partner with the IRS and enable the success of the PDC Program: CBE Group, ConServe and Coast Professional, Inc.

With hundreds of billions in federal taxes uncollected each year, the government’s partnership with private recovery specialists returns vital funding to the U.S. Treasury – funding used to sustain other critical federal programs – while providing collaborative solutions to help Americans fulfil their tax obligations in a manageable way.