IRS’ private sector partners in tax recovery efforts commit to increased transparency, public education

Washington, D.C. (June 26, 2018) – A group of tax recovery companies from across the nation today announced the launch of a new coalition, the Partnership for Tax Compliance, with a mission to advocate for vital public/private partnerships that return funding to the U.S. Treasury, strengthen the effectiveness of the Internal Revenue Service (IRS) and ensure fairness in the federal tax system.

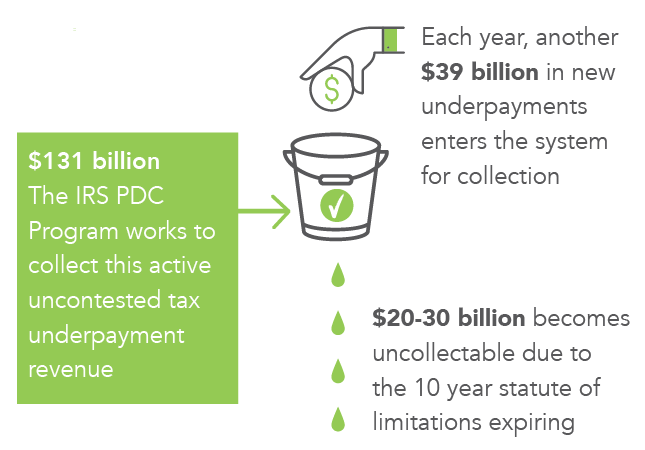

As the federal government struggles to fund infrastructure improvements and sustain entitlement programs, the IRS estimates that the tax gap – the difference between federal taxes owed and those paid each year – exceeds $400 billion. In addition, workforce shortages at the IRS have caused thousands of accounts in arrears to sit untouched for years, with billions lost as accounts age out of a 10-year statute of limitations. Resolving these workforce shortages and reducing a portion of the tax gap would provide the government with resources to fund new and existing federal initiatives.

Created by Congress with passage of the Fixing America’s Surface Transportation Act in 2015, the IRS Private Debt Collection (PDC) Program provides the IRS with private-sector resources to assist with collection of a subset of outstanding tax accounts – underpayments, where a tax return was filed, but the taxpayer acknowledges that additional taxes remain unpaid.

“With concerns rising about our nation’s deficit and federal budget shortages, the Partnership for Tax Compliance advocates for the voluntary collection of legitimately owed taxes to help sustain the important programs that millions of Americans rely upon every day,” said Kristin Walter, spokesperson for the Partnership for Tax Compliance. “The IRS Private Debt Collection Program is a smart and effective solution that will bring in billions of dollars in uncollected tax underpayments while providing taxpayers with collaborative and manageable options that help them achieve a zero tax balance.”

“With concerns rising about our nation’s deficit and federal budget shortages, the Partnership for Tax Compliance advocates for the voluntary collection of legitimately owed taxes to help sustain the important programs that millions of Americans rely upon every day,” said Kristin Walter, spokesperson for the Partnership for Tax Compliance. “The IRS Private Debt Collection Program is a smart and effective solution that will bring in billions of dollars in uncollected tax underpayments while providing taxpayers with collaborative and manageable options that help them achieve a zero tax balance.”

The PDC program empowers private recovery companies to expand the customer service capacity of the IRS to help collect tax underpayment accounts in arrears. Contractors work at the direction of the IRS to conduct outreach to taxpayers and offer solutions like payment plans that allow Americans to voluntarily fulfill tax obligations. The revenue collected by PDC contractors are funds that would not otherwise be collected by the federal government due to a lack of IRS staff and resources. The majority of funds collected by the program goes back to the U.S. Treasury, while a portion serves to bolster the permanent collection and recovery capabilities of the IRS by funding the addition of much-needed internal staff.

While the IRS works toward full implementation of the PDC program, its private sector partners continue to fulfill their obligation to ensure that taxpayers are treated fairly during the recovery process. IRS contractors do not receive any information about a taxpayer’s level of income, have no enforcement authority and are highly regulated. They rely solely on voluntary payment by the taxpayer. As a result, taxpayers with the means to do so are most likely to participate in the program, while those experiencing financial hardship are referred out of the program and back to the IRS.

The Partnership for Tax Compliance will serve as a resource providing access to detailed information about the PDC program and upcoming implementation milestones. The Partnership will also work to increase PDC program transparency with regard to taxpayer engagement, taxpayer privacy safeguards, and the accounts assigned to recovery contractors by the IRS.

“The IRS currently estimates the voluntary tax compliance rate at just 82 percent, so a high level of voluntary tax compliance remains critical to ensure fairness in the tax system,” said Walter. “Those who don’t pay what they owe ultimately shift the tax burden to those who meet their tax obligations, and legitimately owed taxes that remain uncollected prevent the federal government from effectively creating and sustaining programs that benefit millions of Americans each year.”

Related Post

Taxpayer Advocate Service...

Taxpayer Advocate Service misleads Congress about the IRS Private Debt Collection Program...

- July 9, 2018

- By Kristin Walter

- Featured Announcements

Year 1 results: IRS Private...

Year 1 results: IRS Private Debt Collection Program successfully boosts agency and U.S....

- August 22, 2018

- By Kristin Walter

- Featured Announcements

PCAs receive an A grade on...

PCAs receive an A grade on both quality control and customer satisfaction Washington,...

- September 10, 2018

- By Kristin Walter

- Featured Announcements

IRS Private Debt Collection...

IRS Private Debt Collection Program raises $88.7 million Doubles revenue generated for...

- October 30, 2018

- By Kristin Walter

- Featured Announcements

Innovative IRS payment plans...

Innovative IRS payment plans help make a dent in the tax gap Washington, D.C. (November...

- November 28, 2018

- By Kristin Walter

- Featured Announcements

IRS Private Debt Collection...

IRS Private Debt Collection Program brings in $130.6 million in tax revenue previously...

- March 12, 2019

- By Kristin Walter

- Featured Announcements